The fastest-growing food company in the U.S. is facing a problem.

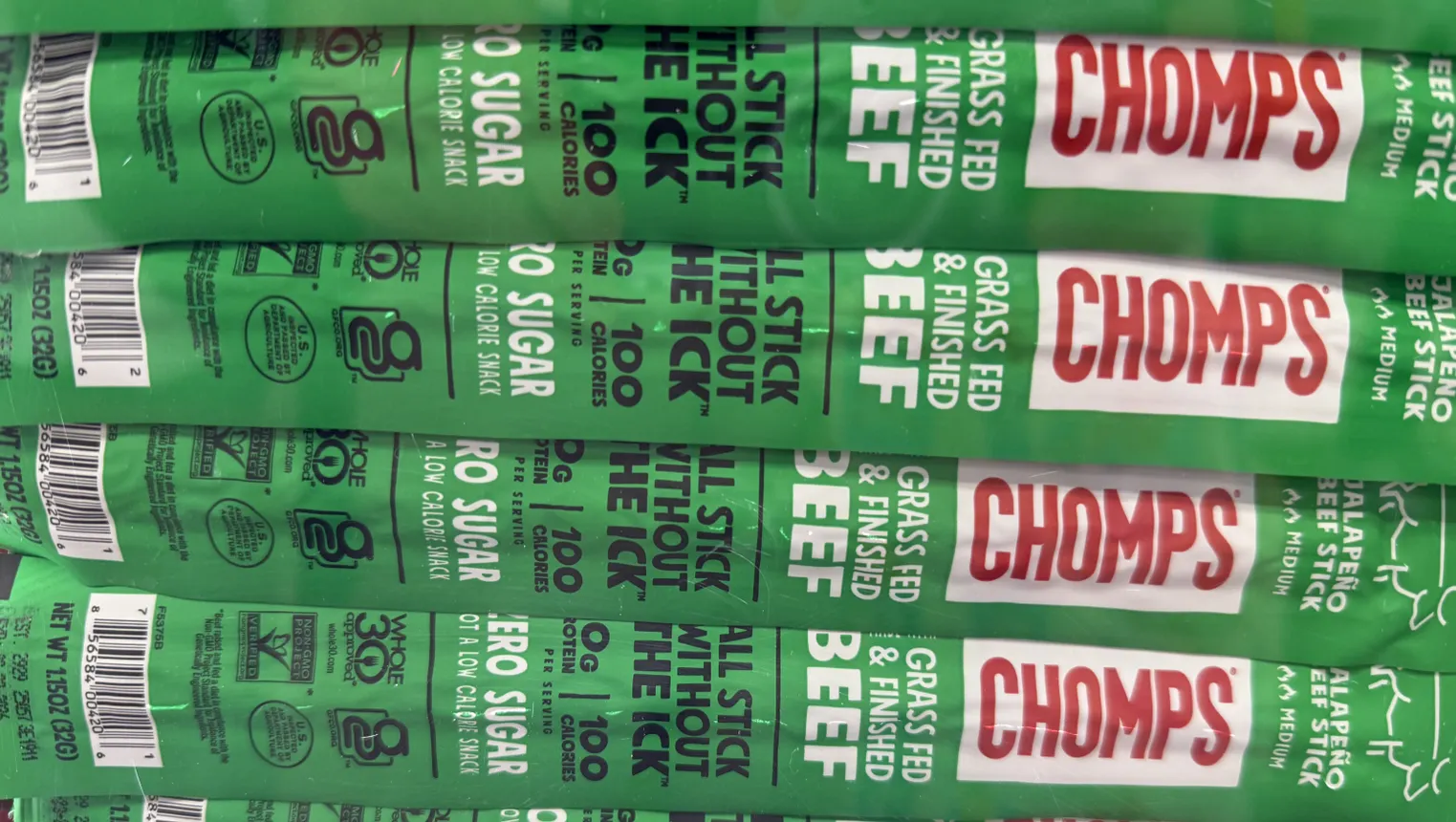

Meat stick maker Chomps is producing 2 million of its cylindrical snacks a day, but demand is so robust that it can only fulfill 85% of its orders.

It’s forced to turn down requests from new retailers interested in carrying its product to ensure it can maintain quality and keep existing customers happy. Chomps is also holding off on entering new geographic markets and developing additional snack options until it can meet existing demand for its core offerings.

It wasn’t that long ago that the challenges facing Chomps would have been a fantasy in a meat sticks space where the product was once viewed as salt-laden and highly processed. Now, meat sticks are viewed as a portable and convenient snack that’s packed with protein, hitting on some of the buzziest trends in the food space.

Sales of dried meat snacks, excluding jerky, rose 10.7% to $3.3 billion in 2024 from the prior year, according to data provided by Circana. Since 2020, the category has added nearly $1.2 billion in sales.

Chomps alone is on track to generate close to $1 billion in sales compared to just $50 million in 2019, according to the company. It plans to add more than 22,000 new distribution points in 2026, and it is opening a 300,000-square-foot manufacturing facility in Missouri later this year that will allow it to “substantially” increase its production.

It’s far from the only meat stick maker thriving.

Jack Link’s recently opened its $450 million processing plant in Georgia, which will employ 800 people. And Archer announced plans for a second plant in Los Angeles that will nearly double its manufacturing capacity following a 90% year-over-year sales increase.

“The explosive growth of our meat stick products made increasing our production capabilities essential,” Eugene Kang, founder and CEO of Archer, said in a statement.

Sticking out in a fast-growing category

For years, meat sticks were considered by consumers to be unhealthy and laden with artificial preservatives or additives.

Matt Landen, the senior vice president of business development with Chomps, said it was hard for meat sticks to shake off this reputation and attract hesitant consumers — even after the sector had evolved and new products more attuned to what consumers were looking for had been introduced.

But as consumers demand more protein and convenience, it’s not hard to see why the sector has taken off. Each Chomps stick contains 10 to 12 grams of protein, roughly equivalent to two eggs. Recently, the meat sticks sector also has seen an uptick among consumers taking GLP-1 medications.

“It feels like we’re building momentum,” said Landen. “When you kind of go back to that household penetration and how quickly we’re building, it feels like those walls are coming down.”

Optional Caption

Christopher Doering/Food Dive

In addition to protein, a major part of the attractiveness of meat sticks is also their versatility, which enables producers to cater to the needs of more shoppers and quickly respond to evolving trends.

Sticks come in various lengths as well as flavors, such as Jalapeno, Tex-Mex, Smoked Mesquite and Dill Pickle. They can be grass-fed, organic, or low in sodium. Some sticks can snap when bitten into, while others have a softer texture.

The vast assortment has provided more reasons for consumers to turn to meat sticks, and helped attract users to the category who may have been hesitant in the past.

“There is a lot of opportunity and room for some brands to play around with,” said Claire Flannery, the senior director of marketing and media for Greenridge Naturals, a Chicago-based maker of meat sticks, deli meats and sausages. “The sky’s the limit in terms of what’s possible.”

Conagra Brands, the owner of Slim Jim, Duke’s and Fatty, has one of the biggest and most diverse portfolios of meat sticks, using each brand to tout different attributes that are important to the consumer.

Slim Jim highlights flavor and innovation, including its upcoming Buffalo Wild Wings Chicken sticks, while Fatty promotes a recognizable ingredients list in addition to grass-fed beef and pork raised without any antibiotics. Duke’s chooses to highlight the appeal of a small-batch, crafted meat stick with fresh ingredients.

“It gives us the ability to cover more demand spaces for the consumer and cover the landscape by leveraging the right brands and products to meet consumers’ needs,” said Matt Brown, brand director for Slim Jim.

Conagra generates more than $1 billion in sales from meat sticks annually. Brown said some offerings could have difficulty playing in an area not associated with the product, such as Slim Jim in better-for-you, or Duke’s as a bold, flavor-first chicken stick.

Looking beyond meat sticks

The suddenly crowded meat stick space has also placed growing importance on new offerings to find a way to differentiate themselves.

When jerky giant Jack’s Link rebranded its better-for-you LK line in 2024, it chose to give more attention to the fact that the snack was free of the top nine allergens rather than its use of meat from grass-fed cattle and free-range chicken and turkeys. Lorissa Link, the daughter-in-law of Jack Link’s founder, came up with the idea after her son was diagnosed with severe food allergies and couldn’t eat many of the snacks in the family pantry, including some of Jack’s Link’s products.

With 85 million people avoiding food due to an allergy or some type of intolerance, the meat sticks market was ripe for a product to fill the void, according to Emily Arthurs, senior director of LK Snacks. It also provided a chance for Jack’s Link to establish a presence in the natural channel that it previously lacked.

“That’s the true point of differentiation when you compare us to all other competitors in the better-for-you space,” Arthurs said.

But just because meat stick makers seemingly have an open slate when it comes to innovation, some have chosen to go with the mantra that less is more, especially when it comes to flavors. Greenridge only sells three flavors, while Chomps has nine, with its original variety producing about half of its sales.

Optional Caption

Christopher Doering/Food Dive

Meat snack makers are confident the strong growth trajectory is unlikely to abate anytime soon. They point to the category’s ability to connect with trends, such as snacking, protein and convenience, that continue to resonate with the consumer. These attributes have even helped meat sticks siphon business away from other snacking categories.

Chomps, for example, doesn’t view its competitors as other meat stick manufacturers, but rather other salty snack makers, according to CEO Rashid Ali.

Roughly two-thirds of Chomps’ consumers have never tried jerky before, he said, a sign that it’s bringing in new consumers to the category. Many of those users are coming from chips, bars and mixed nuts where Chomps is grabbing market share.

“We want to win in protein snacks. It’s a $26 billion category,” Ali said. “That’s why you’re seeing all these other entrants [in meat snacks] because they’re seeing the category grow so quickly.”

Christopher Doering

2025-09-15 13:00:00