The healthy foods and beverages movement has surged from a niche wellness trend to a powerful cultural and political force. Driven by growing public concern over chronic disease, ultra-processed diets, and corporate influence in the food and pharmaceutical industries, Americans are increasingly demanding transparency, accountability, and healthier options in what they eat and drink.

At the forefront of this shift is the Make America Healthy Again (MAHA) initiative. From banning artificial dyes and preservatives to advocating for whole, nutrient-dense foods, MAHA is reshaping the national conversation around wellness and nutrition.

For CPG manufacturers, the MAHA movement represents a seismic shift in consumer expectations – one that extends far beyond product formulation. With its broad platform advocating for bans on artificial ingredients, endocrine-disrupting chemicals in personal care products, and greater transparency in public health policy, MAHA is redefining what it means to be a “healthy” brand.

This movement challenges manufacturers to not only clean up ingredient lists but also to align with a more holistic vision of wellness that includes sustainability, ethical sourcing, and proactive disease prevention. Brands that can authentically respond to these demands through innovation, reformulation, and transparent communication stand to gain consumer trust and long-term loyalty in a rapidly evolving marketplace.

So far, The FDA, under the MAHA initiative, has announced a ban on nine artificial food dyes, including Red 40, Yellow 5 & 6, and Blue 1 & 2, with full phase-out expected by the end of 2025 Red Dye No. 3, previously slated for phase-out by 2027–2028, is now being pushed for removal by end of 2026.Supporters of the movement argue that it represents a long-overdue correction to decades of industrialized food production and marketing practices that have prioritized profit over public health.

Beyond the FDA banned ingredients, the rise of consumer-facing technology like Yuka is accelerating the pressure on CPG manufacturers to clean up their ingredient lists and embrace radical transparency. With a quick scan of a barcode, consumers can instantly access detailed health ratings and alerts about potentially harmful ingredients in food, beverages, and personal care products. Apps like Yuka are empowering everyday shoppers to become watchdogs, calling out brands for using additives, preservatives, or chemicals flagged as toxic or endocrine-disrupting. This democratization of product scrutiny is shifting the balance of power, making it harder for brands to hide behind vague claims or legacy formulations. For CPG companies, this means that reformulation is becoming a competitive imperative in an era where digital tools are shaping consumer trust in real time.

Several brands are already taking action:

- McCormick: Dropping certain food dyes

- PepsiCo: Reformulating Tostito’s and Lay’s chips to remove artificial ingredients by the end of the year

- Tyson Foods: Working to remove petroleum based artificial dyes

- Mars Wrigley: Removed titanium dioxide from Skittles

- JM Smucker and Hershey: Committing to getting rid of synthetic colors

Many brands working to reformulate with prioritization on products served in K-12 schools.

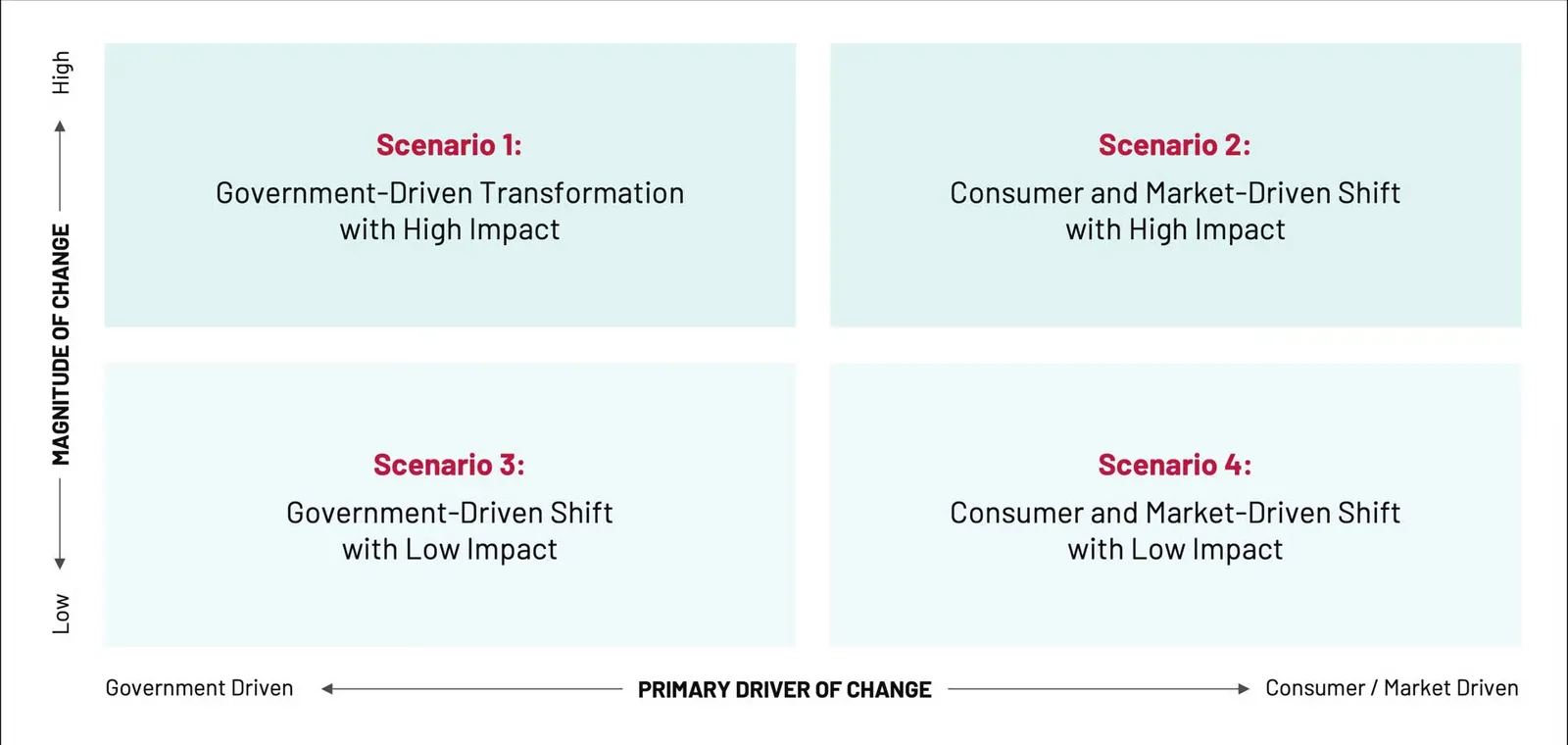

Exploring Possible Futures: Scenario Planning

As this movement continues the next four to five years could bring a range of outcomes, depending on the primary forces driving change—whether regulatory, market-driven, or consumer-led. To help navigate this uncertainty, we’ve outlined four distinct scenarios that illustrate how this movement might evolve and what each path could mean for manufacturers. These scenarios vary in magnitude and speed of impact, offering a strategic lens through which companies can prepare, adapt, and thrive.

Permission granted by Kalypso: A Rockwell Automation Business

Scenario 1: Government-Driven Transformation with High Impact

In one possible trajectory, the healthy eating movement accelerates rapidly under strong government intervention. This scenario includes sweeping legislative changes – such as an expanded scope of FSMA 204 and new state-level regulations – that compel CPG manufacturers to respond immediately and decisively.

Key developments include:

- Swift executive actions that reshape compliance expectations overnight.

- Public accountability campaigns, with government officials spotlighting non-compliant or “bad actor” companies.

- Heightened regulatory scrutiny, including more frequent audits and stricter enforcement of traceability and GRAS (Generally Recognized As Safe) standards.

For manufacturers, this would trigger a cascade of operational shifts:

- Urgent product reformulations to meet new ingredient and safety standards.

- Raw material and vendor reevaluation, potentially requiring new sourcing strategies.

- Manufacturing overhauls, including equipment recalibration and packaging redesigns.

- Inventory management challenges – existing raw materials, WIP, and finished goods may become obsolete under new regulations.

This scenario demands agility, transparency, and a proactive approach to compliance, turning regulatory pressure into an opportunity for innovation and consumer trust-building.

Scenario 2: Consumer and Market-Driven Shift with High Impact

In this scenario, the healthy eating movement gains unstoppable momentum through cultural influence and consumer activism. Rather than being led by legislation, the change is powered by a growing national consciousness around food and wellness – amplified by media, influencers, and technology.

Key developments include:

- Widespread media representation, with documentaries, fictional stories, and embedded messaging across social media, streaming platforms, and traditional outlets.

- Influencers emerge as powerful voices, shaping public opinion and driving demand for transparency and healthier options.

- Digital tools like Yuka become central to consumer decision-making, with the app acting as a “kingmaker” in validating acceptable products and brands.

- Consumer-led boycotts and influencer campaigns materially impact company performance, forcing rapid responses.

For CPG manufacturers, reformulation and compliance are no longer optional, they’re expected. Companies must align with consumer values or risk losing relevance. This scenario rewards brands that are proactive, transparent, and authentically committed to health and sustainability.

Scenario 3: Government-Driven Shift with Low Impact

In this scenario, initial regulatory momentum in 2025 begins to fade as government attention shifts to other pressing national issues. While some progress is made, the pace of change slows considerably, resulting in a more measured and predictable impact on the industry.

Key developments include:

- FSMA 204 is implemented as scheduled in 2027, without additional delays or expansions.

- GRAS disclosures are required, but only in relation to each company’s own published standards, limiting the scope of accountability.

- Federal disputes with manufacturers remain rare, with most companies opting for quiet compliance rather than public resistance.

This scenario offers stability and time to adapt. While some adjustments may be necessary, the overall impact is manageable, allowing companies to evolve their practices gradually without major disruption.

Scenario 4: Consumer and Market-Driven Shift with Low Impact

This version of the future suggests that the healthy eating movement influences consumer behavior and brand strategy, but the overall impact on the industry remains modest. Food and beverage companies acknowledge the trend, making visible concessions to satisfy consumer expectations, without undergoing major operational or financial disruption.

Key developments include:

- Targeted messaging adjustments, as companies strategically redirect the conversation and challenge influencer narratives.

- Incremental product changes, such as setting long-term goals to reduce food dyes and preservatives.

- Minimal financial impact, with no significant shifts in operating results or market share.

For manufacturers, this would be a controlled response to consumer pressure, where brands maintain flexibility, protect profitability, and manage perception without overhauling their core business models.

The Inevitable Shift in Food and Beverage Manufacturing

Across all four scenarios, whether driven by government regulation or consumer demand, the message is clear: food and beverage formulation and manufacturing are on the brink of transformation.

Things to Consider:

- Even in the absence of sweeping legislation, rising consumer health expectations will continue to push brands toward more frequent reformulations.

- Elevated consumer expectations for transparency, ingredient clarity, and brand accountability are expected.

- Executive urgency around traceability, despite FSMA 204’s deadline being extended to 2028. Companies will need to establish robust programs, including processes, RACI models, and enabling technologies, well ahead of formal requirements.

- Operational challenges, such as increased spoilage rates for raw materials and WIP due to reduced use of preservatives.

- Potential regulatory evolution, with FSMA 204 subject to modification, new legislation introduced, or executive orders enacted.

- Expanded scope of regulation, likely to include categories beyond produce and protein—such as snacks, candies, cereals, soft drinks, frozen foods, and other high-consumption items.

- Broader traceability requirements, with Critical Tracking Events (CTEs) and Key Data Elements (KDEs) potentially extending deeper into manufacturing and distribution processes.

Together, these shifts signal a future where agility, transparency, and proactive compliance will be essential for CPG manufacturers to remain competitive and trusted.

Strategic Recommendations for Navigating Change

Regardless of which scenario unfolds, food and beverage companies must take proactive steps to stay ahead of evolving expectations and regulatory landscapes. The following recommendations span strategic, product development, and operational areas to help manufacturers build resilience and readiness.

Strategic & Organizational Readiness

- Strengthen government affairs capabilities to monitor, interpret, and influence policy developments. Generative AI models can help simulate regulatory changes and their potential impact, helping teams prepare.

- Invest in “always on” voice-of-the-customer and market intelligence to stay attuned to shifting consumer values and behaviors, leveraging machine learning models.

- Establish clear goals and KPIs aligned with health, transparency, and sustainability outcomes and leverage sustainability monitoring to analyze supplier data optimize sourcing.

- Benchmark against EMEA standards, which often lead global trends in food safety and labeling.

- Implement GRAS self-reporting protocols to enhance transparency and build consumer trust.

R&D and Product Development

- Accelerate reformulations through Product Lifecycle Innovation (PLI) to meet emerging health standards.

- Explore fortified food and beverage options to align with wellness trends and nutritional gaps leveraging generative AI for rapid ideation.

- Integrate GRAS disclosures into labeling and advertising to reinforce credibility and compliance.

Manufacturing and Operations

- Deploy robust traceability systems for both compliance and claims messaging for consumers.

- Increase quality and compliance testing to manage food safety risks associated with cleaner formulations.

- Plan for higher rates of raw material and WIP obsolescence, especially as preservatives are reduced or eliminated.

By taking these steps now, CPG manufacturers can not only mitigate risk but also position themselves as leaders in a movement that’s reshaping the future of food. The companies that act early, balancing innovation with transparency, will be best equipped to earn consumer trust and thrive in a rapidly changing marketplace.

Steve Riordan and Hadley Bauer

2025-09-15 09:00:00